Buying your first home is one of the most exciting (and slightly terrifying) milestones in life. If you’re a first-time homebuyer earning around RM3,500 a month in Malaysia, you might be thinking, “Is it even possible to own a house in this economy?” The short answer: Booyah! Yes, it is. Whether you are looking for […]

Buying your first home is one of the most exciting (and slightly terrifying) milestones in life. If you’re a first-time homebuyer earning around RM3,500 a month in Malaysia, you might be thinking, “Is it even possible to own a house in this economy?”

The short answer: Booyah! Yes, it is.

Whether you are looking for financial security or an aspiring investor ready to build your first portfolio, this guide is for you. We’ve broken down the “secret” to securing your first asset without losing your sanity or your savings.

Let’s get real. Many people complain that an RM3,500 salary in Kuala Lumpur is only enough for survival. Moreover, during the inflation, the price of goods is rising but the salary only increases by a small amount.

As a first-time homebuyer, your focus should be on “entry-level” properties. In the current Malaysian market, this typically means looking at homes priced between RM250,000 and RM350,000.

Why? Because your monthly mortgage should ideally stay under RM1,200 to RM1,400. This leaves you enough money for your car loan, insurance, and that occasional self-reward.

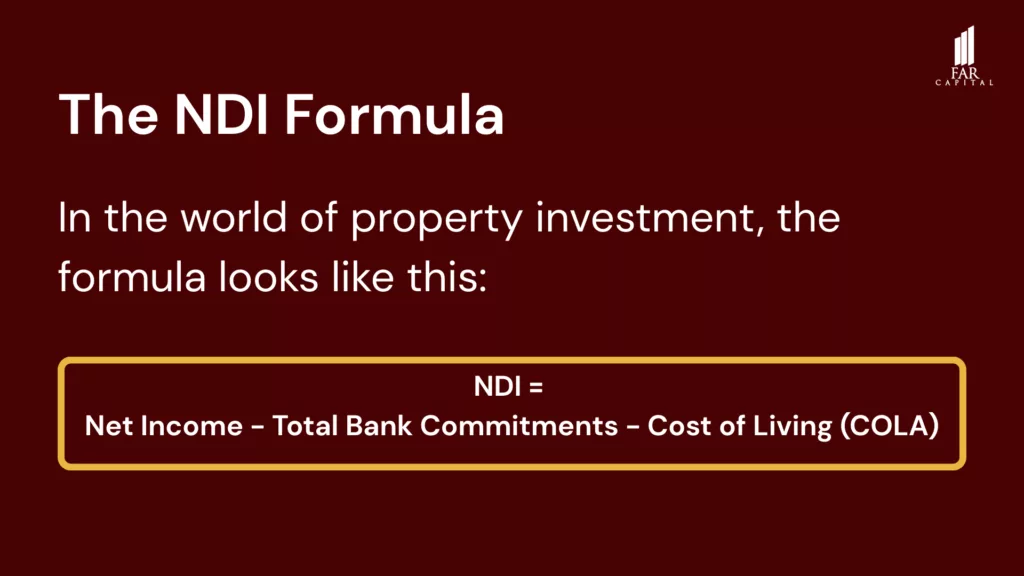

The bank actually looks at Net Disposable Income (NDI). NDI is the “remaining money” that is left in your pocket after you deduct all bank debts and basic living costs set by the bank.

Of course, the bank doesn’t just want to see if you can afford to pay the installments for your new home, but it wants to make sure that you don’t die paying after paying off the debt.

As a first-time homebuyer, you need to understand that every bank has a “poverty line” for its applicants. If the bank decides that a person living in KL needs RM1,500 to survive (food, petrol, utilities), and your leftover cash after a new loan is only RM1,200, they will reject you.

Not because you are poor, but because they don’t want to be the reason you’re eating instant noodles for the next 30 years!

To secure your first asset, you need to prove that your Net Disposable Income is healthy. This is why structured learning in property investment is vital.

This is your “home-pay” salary. Don’t use your gross salary!

The bank only cares about “official” debts that show up in your CCRIS/CTOS report.

This is the “Hidden Variable.” Every bank has a different minimum NDI requirement based on your location.

Note: This is the money the bank assumes you need for food, petrol, and your Netflix subscription. If your balance is lower than their COLA threshold, they will reject your loan even if your DSR (Debt-Service Ratio) is perfect!

Let’s see if a first-time homebuyer earning RM3,500 in KL can pass the NDI test for a RM300,000 house:

The Verdict: Since RM1,000 is LESS than the RM1,500 required for KL, the bank might say, “Sorry, bro. You might starve!” and reject the application.

With a salary of RM3,500, your goal is asset ownership, not just a roof. Chasing a RM600,000 bungalow is a fast track to rejection. Instead, aim for properties priced between RM250,000 and RM350,000.

Even if you find the perfect house in the sweet spot, you won’t get the keys if your Net Disposable Income (NDI) is thin.

Which is why, to ensure the bank says “Yes,” you need to bridge the gap between your salary and your target:

Being a first-time homebuyer with a RM3,500 salary isn’t about being rich, it’s about being smart. By understanding your Net Disposable Income and managing your DSR, you are not just buying a house, you are securing your future.

Property investment is a marathon, not a sprint. Start with what you can afford, learn the ropes, and watch your net worth grow.