If you are a first-time homebuyer in Malaysia, you’ve probably felt that stinging “slap of reality.” You know the one: you graduated with big dreams of owning a home, but now you’re looking at property prices in KL and wondering if you’ll be renting until you’re 80. Imagine this: 90% of people have no clue […]

If you are a first-time homebuyer in Malaysia, you’ve probably felt that stinging “slap of reality.” You know the one: you graduated with big dreams of owning a home, but now you’re looking at property prices in KL and wondering if you’ll be renting until you’re 80.

Imagine this: 90% of people have no clue how to maximize their financial potential when buying a house. They think it’s just about having a roof over their head, but for the smart M40 middle class, it’s actually the ultimate “cheat code” to financial security.

Whether you want to stay in it or use it as an investment, being a first-time homebuyer doesn’t have to mean being “house poor.” In fact, with a structured approach, you can acquire your first asset without draining your life savings.

Back in university, there was always that eagerness to grow up. You wanted the high-paying job to ease your parents’ burden, a decent car, and most importantly, your dream house. However, as soon as you stepped into the working world, reality hit like a brick.

Not only is the starting salary often underwhelming, but there’s also a massive sense of guilt. You want to save for a home, but your current income barely covers the basics, bills, and, ironically, the rent for a place you’ll never own. It’s a constant struggle. The money you set aside to become a first-time homebuyer often ends up being used to pay your current landlord.

It’s a paradox: you’re paying for a roof today at the expense of owning one tomorrow. For many in the M40, it feels like renting will be a lifelong affair. But is renting always bad? Not necessarily if you know the math.

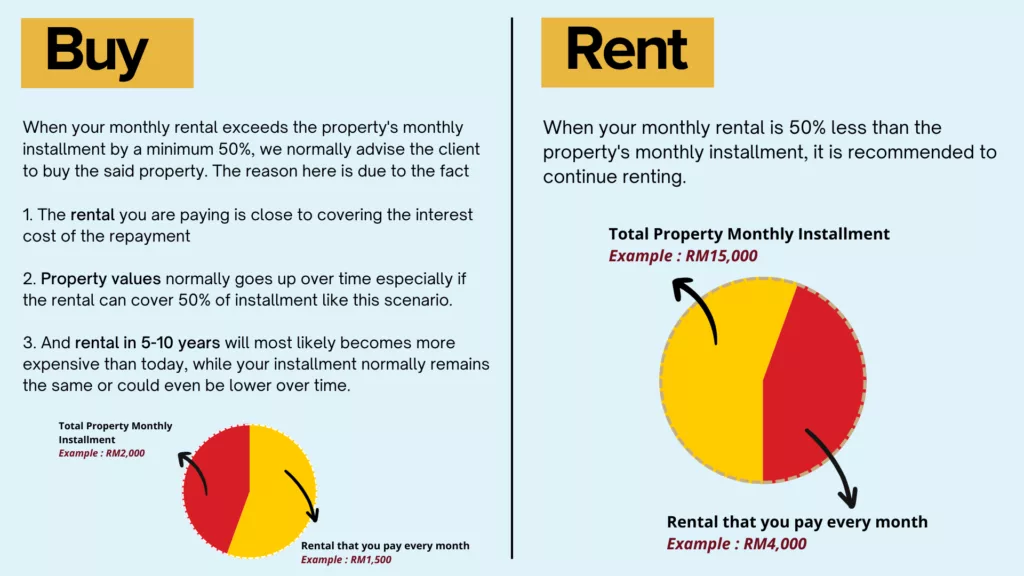

How do you know when to stop renting? Deciding between renting and buying is complex, but we can simplify it with the 50% Rule.

If you are paying RM1,800 in rent for a condo where the mortgage is RM2,000, you are essentially “losing” the chance to build equity.

As a first-time homebuyer, making a decision based on this ratio ensures you aren’t overleveraging yourself while the market moves past you. You are missing out on the opportunity to own an asset with your current income.

The biggest mistake most Malaysians make is waiting until they can afford their “Dream Home.” They want the 4-bedroom landed house in a posh area as their first purchase. Stop. Your first house isn’t a trophy; it’s an ENTRY POINT.

Think of it as a wealth starter pack. It doesn’t need to be the house you retire in. It just needs to get you into the game. By becoming a first-time homebuyer in a strategic location, even if it’s a smaller unit, you start benefiting from the 5% annual property appreciation in Malaysia.

The Entry Point Workflow:

Your first house is a door for long-term wealth, not a place to brag on social media. It just needs to get you in the game.

You’ve been told you need a 10% deposit. In today’s market, that’s “old school” thinking. A savvy first-time homebuyer can actually get paid to buy a house.

By identifying properties sold Below Market Value (BMV), you can secure a 90% or 100% loan (especially under schemes like Skim Rumah Pertamaku or developer rebates).

The Result?

Cashout after VP (Vacant Possession).

When you get the keys, the bank releases the full loan amount based on the valuation. If you bought it cheap, the excess money goes to you. Imagine buying a property for RM400,000 that is valued at RM450,000. That RM50,000 difference can be your cashout.

This cash can be used to:

Being a first-time homebuyer is the ultimate tool for financial “spring cleaning.” If you receive RM50,000 in cashback from your purchase, you can use that to kill off “bad debts” like credit card balances.

By renting out your property, the tenant pays your mortgage. This is Good Debt. The bank is being paid, your net worth is growing, and you might even have extra monthly cash flow.

Imagine this scenario:

You’ve essentially used the bank’s money and a tenant’s rent to build a fortune.

Don’t wait to buy your first house. Right now, property prices in Malaysia are soaring. Between 2009 and 2019, condos like Park Residence in KL increased from RM320,000 to RM1.2 million. That is RM900,000 increase in just 10 years!

If you think prices are expensive now, imagine the price in 5 years. The longer you delay becoming a first-time homebuyer, the harder it becomes. Property prices in Malaysia increase by around 5% annually. Rent prices also rise alongside property values. Eventually, your rent will be as high as a mortgage installment anyway but you’ll have zero assets to show for it.

We believe that each of us deserves the right to own a home. With the right approach, you can still buy your own home even if your current income is not substantial. This is a guide to educate you on how to buy a house without losing any money.

Stop being a spectator. This is for those who are consistently pessimistic about their capabilities. You don’t need to be rich to start; you just need to be smart and understand the structured learning of property investment.