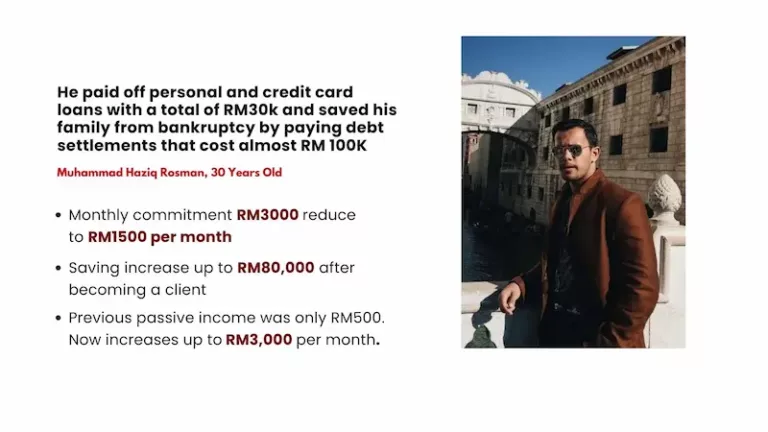

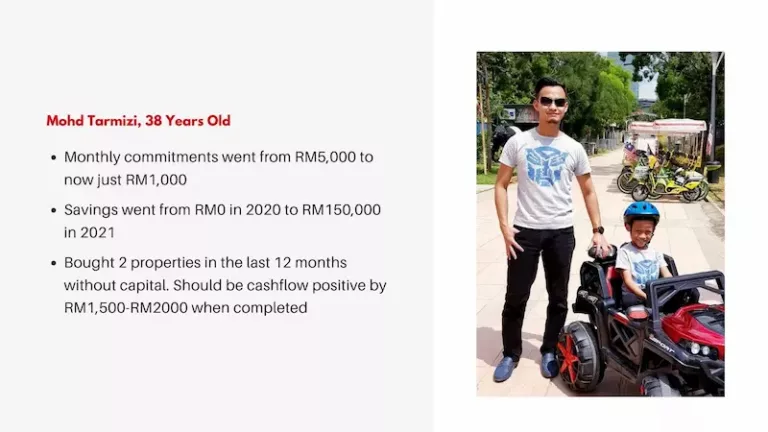

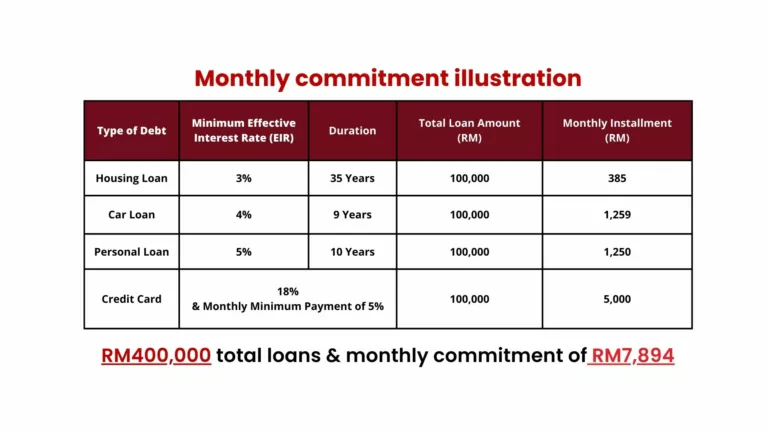

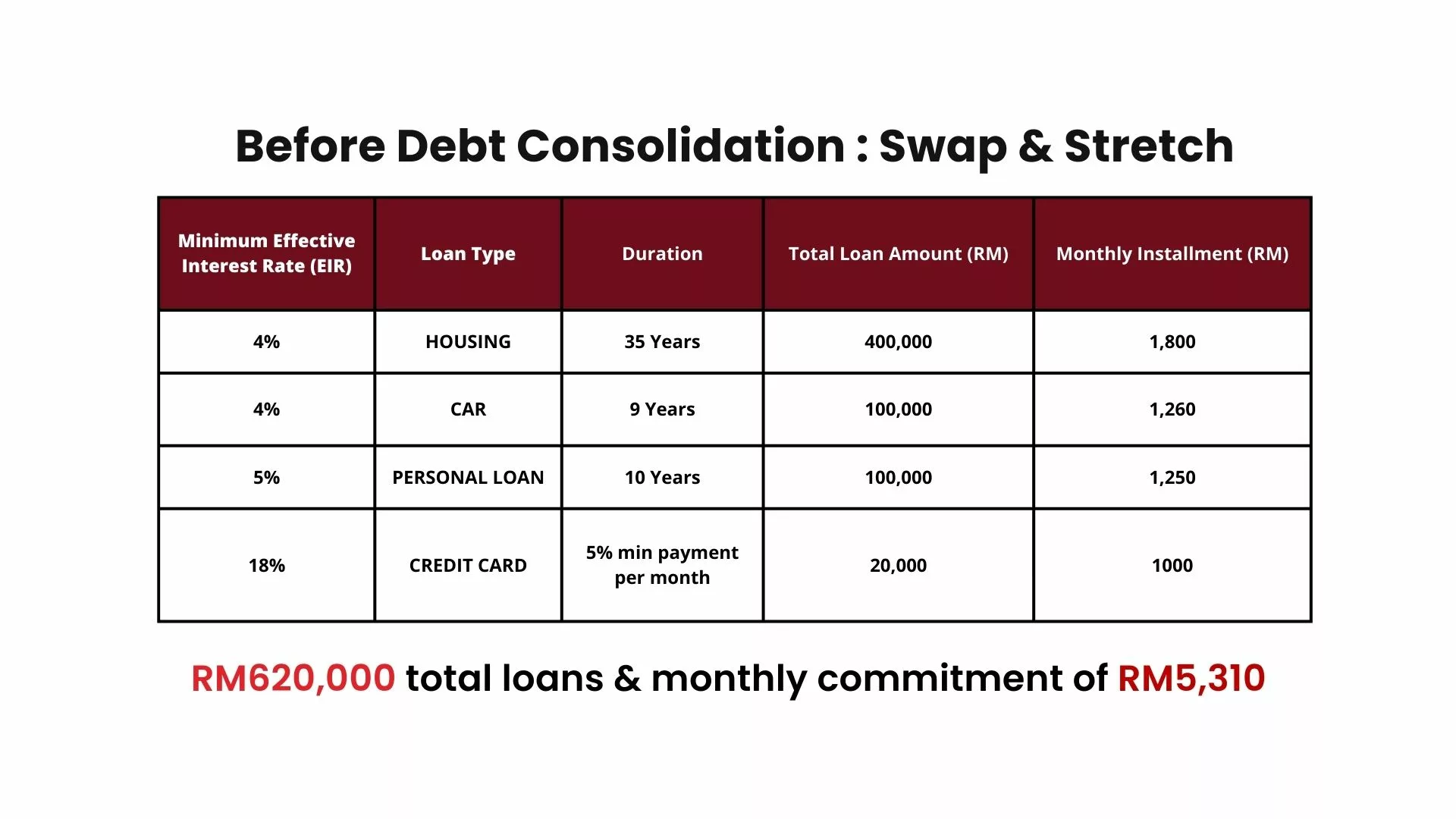

Is it really possible to reduce your monthly commitment by half in the next 12 months?

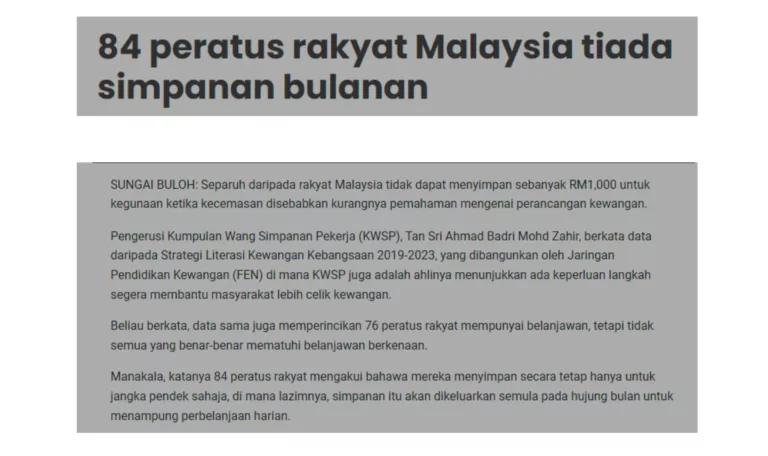

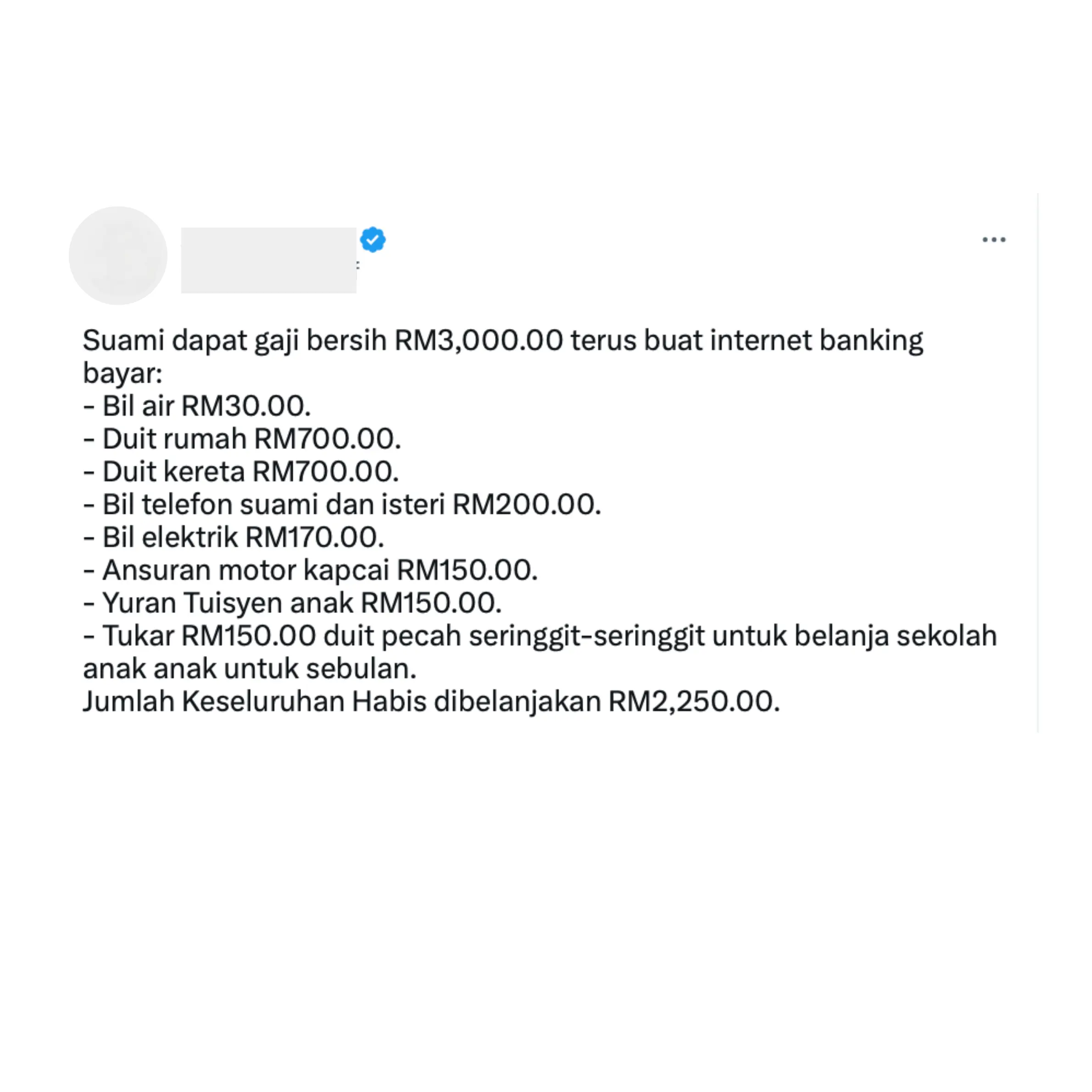

Feeling exhausted from working hard every month

Living like this can make life feel like a never-ending struggle

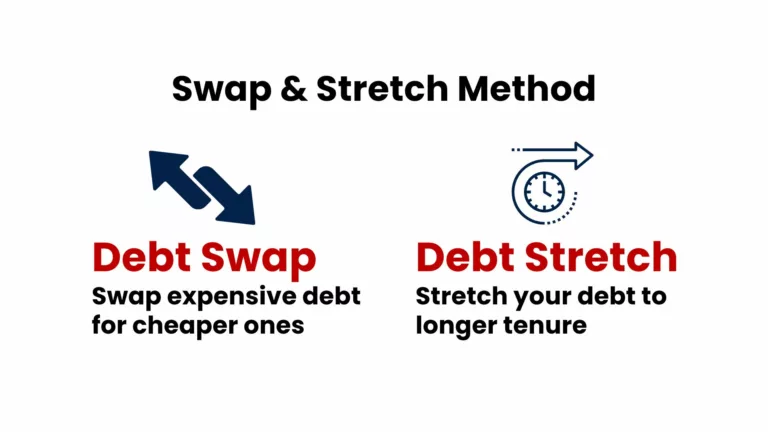

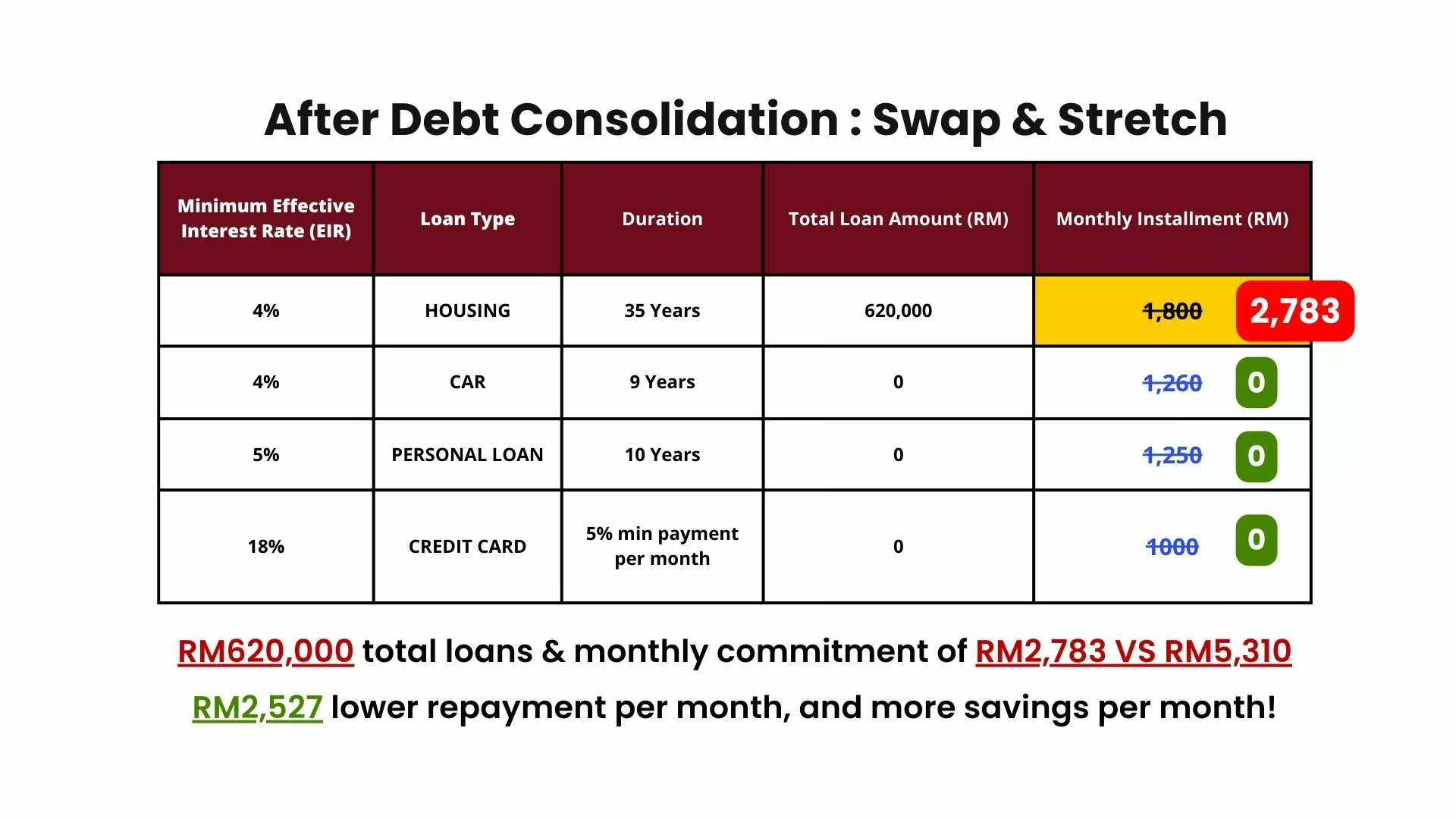

There's hope! You can start cutting your debt in half within a year.