In the cultural tapestry of Malaysia, where diverse traditions interweave, weddings are not just ceremonies; they are grand celebrations of love, unity, and heritage. However, these joyous occasions come with their price tag, often leading many Malaysians to consider personal loans to fund their dream weddings. This article delves into why the allure of a […]

In the cultural tapestry of Malaysia, where diverse traditions interweave, weddings are not just ceremonies; they are grand celebrations of love, unity, and heritage.

However, these joyous occasions come with their price tag, often leading many Malaysians to consider personal loans to fund their dream weddings.

This article delves into why the allure of a perfect wedding day pushes some Malaysians towards financial borrowing, highlighting the costs involved in organizing a wedding ceremony and the critical considerations before taking the plunge into wedding loans.

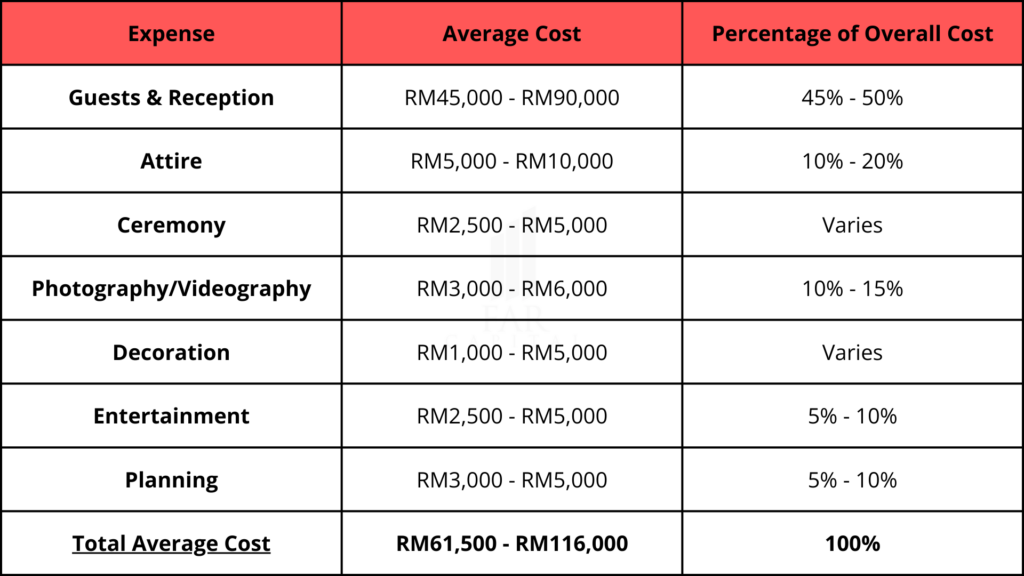

The financial landscape of a Malaysian wedding can be quite the spectacle, ranging from RM50,000 to RM200,000, excluding the honeymoon. Here’s a closer look at where the money might go:

The lion’s share of the budget, approximately 45% to 50%, is devoured by the reception, encompassing the venue, food, catering, and drinks.

Venue costs alone can swing wildly from RM900 to RM1,200 per table in restaurants to RM2,000 to RM3,000 in more upscale 4 to 5-star hotels. It also varied the cost of renting a wedding hall or garden space for a garden wedding.

Bridal attire, a pivotal element of the day, can set couples back RM5,000 to RM10,000, representing 10% to 20% of their budget. The choice of attire ranges widely, from formal wear to traditional garments such as the Malay “Songket,” the Chinese “Kua,” and the Indian “Kurta.”

The ceremony itself, including the exchange of wedding rings (averaging RM2,500 to RM5,000) and other cultural expenses like “mas kahwin” and “Pin Jin,” forms a significant part of the expenses.

Capturing the memories professionally costs RM3,000 to RM6,000, accounting for 10% to 15% of the budget.

Depending on whether couples opt for DIY or professional services, decoration costs can range from RM1,000 to RM5,000.

Hiring MCs, live bands, or DJs for entertainment purposes can cost RM2,500 to RM5,000, making up 5% to 10% of the overall budget.

The logistics of planning, including invitations, RSVPs, guest lists, and seating, usually require RM3,000 to RM5,000 or 5% to 10% of the total budget.

According to the examples given in previous explanations, the minimum cost to get married and fund a wedding ceremony would be RM61,500. Yes, minimum! And it can go up to RM110,000+ and even more!

With the substantial amount of capital required, it’s understandable why many are inclined to apply for a personal loan to finance their special day. Hosting a wedding ceremony is far from inexpensive. The costs can vary significantly depending on various factors, including the number of receptions and the chosen venue’s price.

For those who have already taken out a personal loan to fund your wedding day – it’s okay. What’s done is done. Stay tuned, though, as we might have something for you at the end of this article.

However, for the singles currently saving money for an upcoming wedding – think twice before applying for a personal loan. Please ensure you read the next section, where we will discuss what you should consider before committing to a personal loan.

Although securing a personal loan may seem like the most straightforward path to feeling like a ‘king for a day’ or ‘Raja Sehari’, it also poses the risk of becoming enslaved by financial commitments and bad debts after that.

Therefore, before taking a personal loan, please consider these four factors, along with the worst-case scenario that could happen to you if you fail to comply.

Imagine dedicating a significant portion of your monthly income to repaying a personal loan, leaving you with barely enough to cover basic living expenses.

Worst case: You find yourself in a relentless cycle of debt, compelled to accumulate more debt just to manage day-to-day expenses, severely impacting your financial freedom and mental well-being.

Picture every month ending with your bank balance at zero, with the entirety of your income earmarked for loan repayment, bills, and essentials, leaving no room for savings.

Worst case: An unexpected financial emergency arises, such as a medical issue or a sudden job loss, plunging you into a financial crisis without a safety net, forcing you to either borrow more or make severe lifestyle sacrifices.

Envision the moment you decide to apply for a mortgage, only to discover that your debt obligations have tarnished your creditworthiness, making lenders hesitant to offer you a favorable loan.

Worst case: You’re either outright denied a mortgage or offered one with prohibitively high-interest rates, delaying or completely derailing your dream of homeownership as property prices continue to climb.

Consider the opportunity cost of having your money locked into loan repayments, preventing you from investing in opportunities that could yield significant returns.

Worst case: You miss out on a robust market upswing, foregoing potential gains that could have significantly bolstered your financial portfolio, affecting not just your current financial condition but also compromising your long-term financial health and retirement plans.

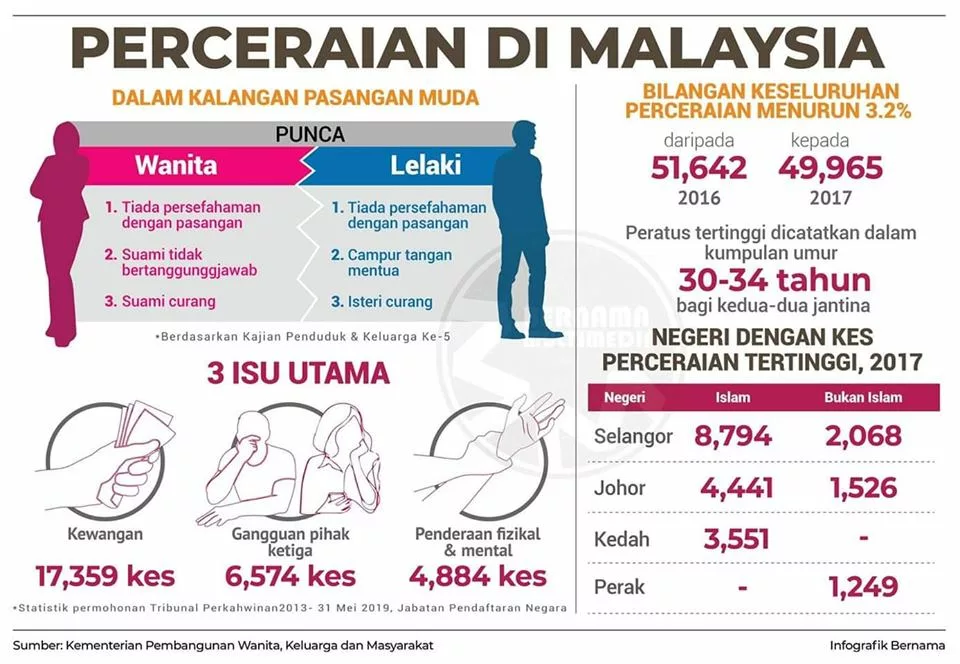

Imagine the tension that arises when money becomes a constant source of stress between you and your partner.

Worst case: Financial pressures lead to frequent arguments, resentment, and a sense of regret, overshadowing the happiness of your marriage. This tension could strain your bond to the point where it impacts your overall relationship satisfaction, reminding us that the financial choices for a wedding can deeply influence the emotional health of a marriage.

Let’s get real for a moment.

The idea of a fairytale wedding is enchanting, and it’s natural to want everything to be perfect. But the reality of taking on a personal loan to fund this dream can cast a long shadow over the future. It’s a decision that intertwines the heart with hard financial truths.

Is it worth it? This question doesn’t have a one-size-fits-all answer. It boils down to personal values, financial health, and the ability to manage debt without compromising future happiness and stability.

Love, after all, isn’t built on extravagant celebrations but on the moments and memories that form the foundation of a partnership. Before signing on the dotted line of a loan agreement, it’s essential to consider whether the joy of one day outweighs the potential strain on many tomorrows.

Ultimately, a wedding is a beautiful beginning to a lifelong journey together.

In Malaysia, where such celebrations are deeply woven into the cultural fabric, the desire for a lavish wedding is understandable. Yet, as we’ve explored, the financial implications of funding this dream with a personal loan warrant careful consideration.

It’s a reminder that the essence of marriage lies in the shared love and commitment between two people, not in the grandeur of the celebration.

As couples navigate these decisions, balancing dreams with practicality, the hope is that they choose a path that brings them joy, security, and a future filled with promise rather than one burdened by debt.

Now, have you decided whether you should take a personal loan or not?

If yes, we would like you to hold that thought first – because we want to offer you something better. What if instead of applying for a loan – which will increase your liability and monthly commitments, you can get married without having to cash out your life savings?

And even better, what if we say you can get married for free, and other people’s money will pay all your expenses? How does that sound? Too good to be true? A bit unrealistic? You might think all that, but you can make it possible with the right strategy.

As a token of appreciation for those who read this article until the end, we would love to educate you more about this strategy – and we’re sharing a portion of it for free. All you need to do is click THIS LINK RIGHT HERE and learn more, okay?

If this is the first time you heard about us, we would gladly share that we’ve been educating Malaysians when it comes to awakening their financial literacy and also about property investment.

If you think that getting married is too good to be true, you can discover and ask thousands that we educated before – most of them have successfully or are on their way to achieving their financial and investment goal.

Don’t feel like you’re up for it yet? No worries, we understand your concern. Therefore, if you like more personal advice – you can reach out to our Success Manager via WhatsApp and tell/ask them whatever – whether you should take a personal loan or other issues too. Say hello to our experts HERE.

We hope this article has been insightful, and we’re excited to help you achieve your goals. Feel free to share this article with others who might benefit from it as well.