Reclaim Your Peace Of Mind Now Debt is common for many, but when it spirals out of control, it can become overwhelming. Bad debt, characterized by high-interest rates and an inability to keep up with the payments every single month, can affect your financial health and well-being. Whether it’s credit card bills, personal loans, or […]

Debt is common for many, but when it spirals out of control, it can become overwhelming. Bad debt, characterized by high-interest rates and an inability to keep up with the payments every single month, can affect your financial health and well-being.

Whether it’s credit card bills, personal loans, or other outstanding balances, being stuck in a cycle of debt can strike away your happiness and give you stress. So, here are some practical ways for you to tackle, eliminate and get out of the bad debts. In this article, we’ll explore actionable strategies to help you regain control of your finances and set you on the path to a brighter, bad debt-free future.

Let’s dive in!

Creating a plan to get out of debt requires clarity and specificity. You can begin by listing out all your bad debts such as:

i- Type of debt (personal loans, credit cards, or hire purchase).

ii- Outstanding balance for each debt

iii- Interest rate iv- Monthly payment

This gives you a clear picture of what you owe and how much debt you make.

Prioritize paying off your debts with the highest interest rates to minimize the amount you accumulate each month through interest. The debt snowball and debt avalanche methods are two effective approaches:

Once the highest-interest debt is paid off, you’ll have reduced your overall interest burden. While progress may feel slow at first, this approach ultimately helps you get out of debt faster.

An alternative strategy is to focus on paying off your smallest debt first. By paying the minimum on all other debts, you can allocate more towards these smaller debts, eliminating them quickly and boosting your motivation from the start.

You can also combine this method with the previous one by paying off your smallest debts first and then tackling larger debts, starting with the highest interest rate.

If you’re struggling with credit card debt, negotiate with your creditors. Typically, this strategy is best if you’re struggling with monthly payments and debt collectors are contacting you.

Rarely does this tactic work in other instances, as creditors generally only grant settlements to borrowers who aren’t likely to repay their debt in full.

Based on your income and expenses, suggest a repayment plan that works for you and see what your creditor says. Depending on your situation, you might propose monthly payments; if accepted, get a full agreement in writing from the company outlining the plan.

If you’ve reduced your expenses and hit your limit, work toward boosting your income. Some options include: a side hustle, such as freelancing or gig work. Sell items you no longer need. And if you’re good at your job, ask for a raise or change jobs for better pay.

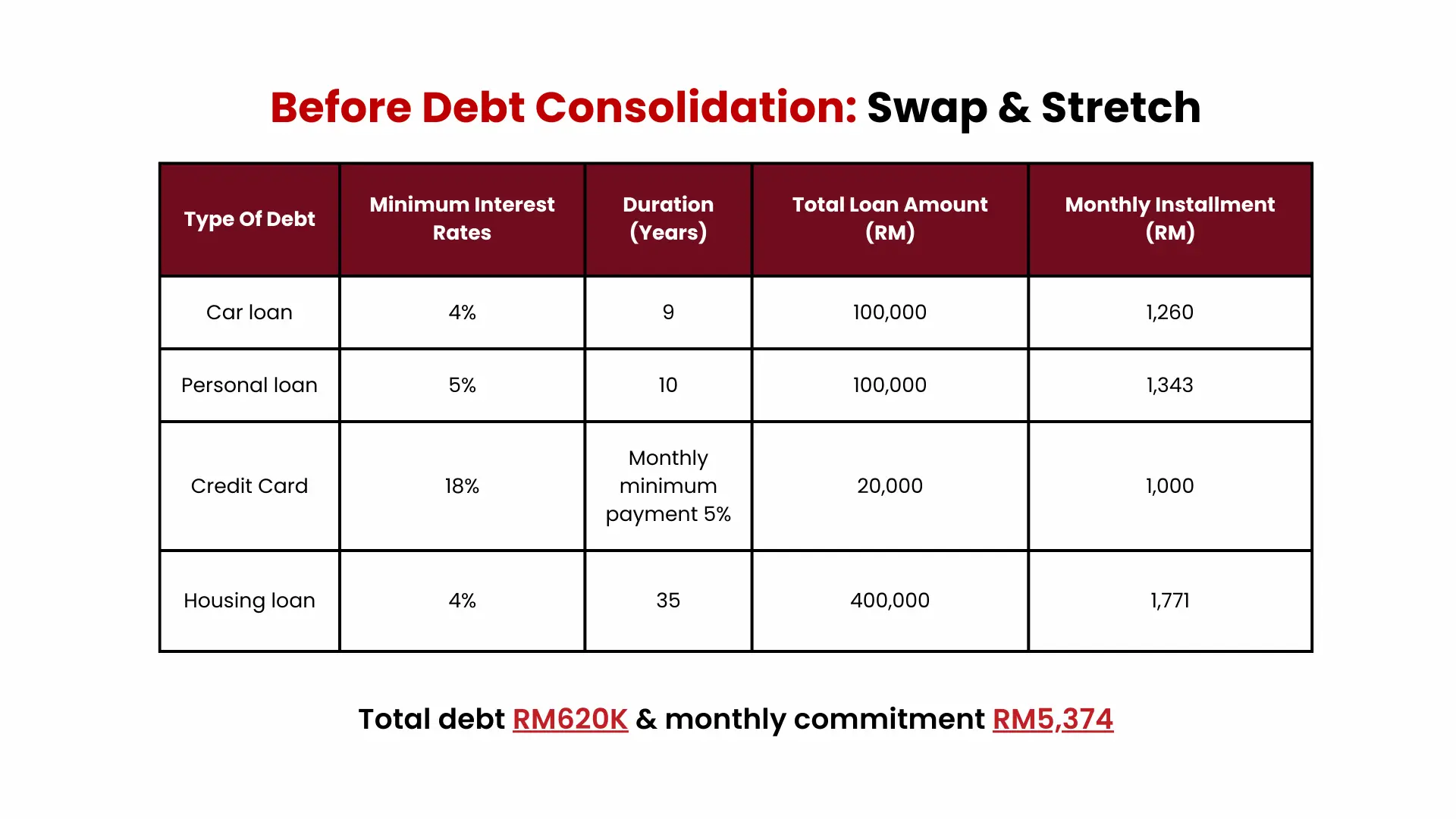

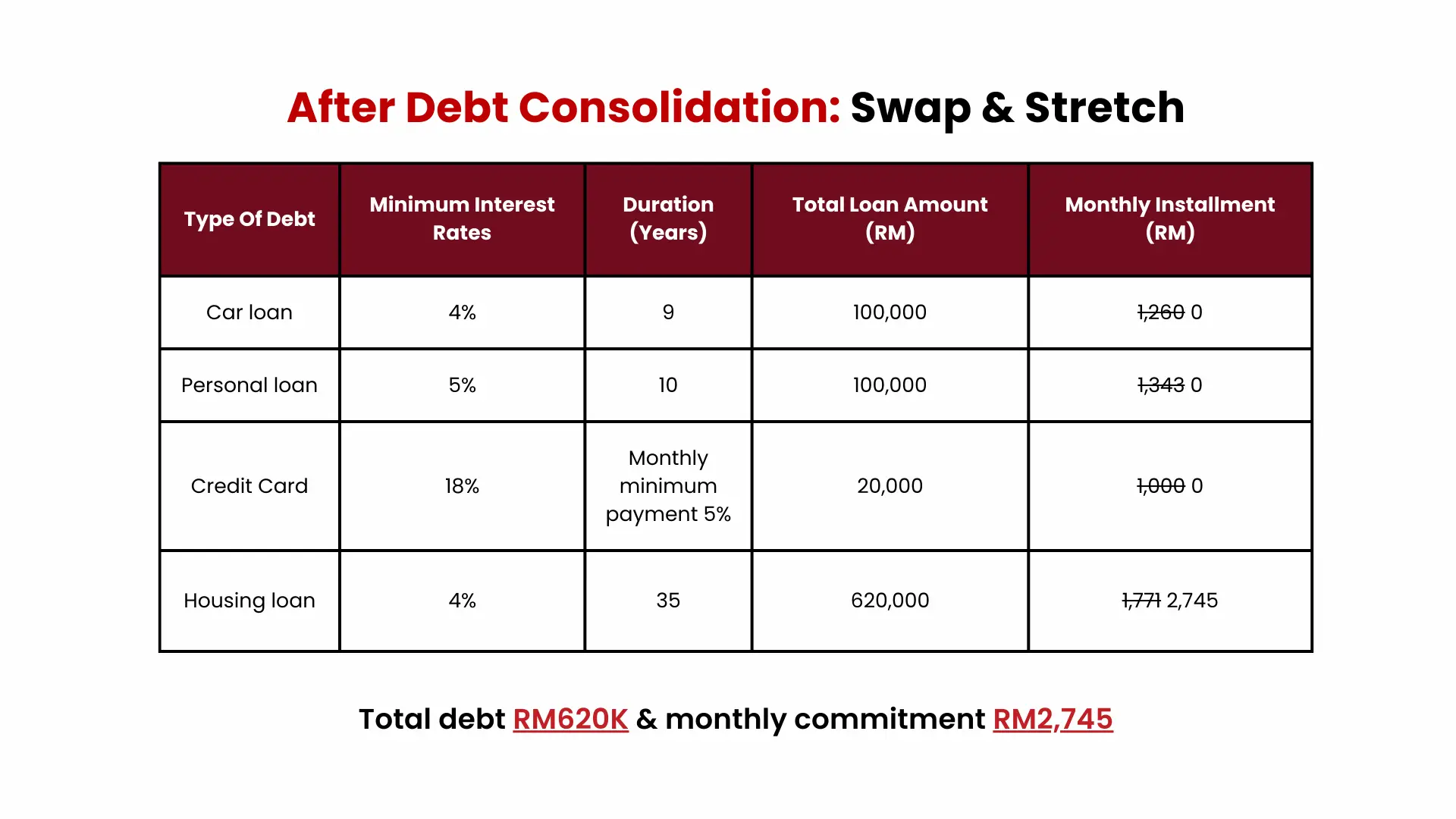

One way to deal with multiple loans at once is to do debt consolidation. This combines your debts into a single debt. Hence, you will only have to deal with one debt. You might also be able to settle your debts with a lower interest rate.

What you can do is choose a property that offers cashback and positive cashflow every month. It can be the best tool to consolidate all your bad debts and reduce your financial burden.

These steps can help you get out of debt and move towards financial freedom. Once your bad debt is paid off, you can focus on building wealth and earning interest instead of paying it.

P/s: However, are there any good property deals that can help you settle your current bad debt? Yes, there are! The property deals that we have as of today, these price advantages you won’t find anywhere else and that can help you for debt consolidation right now!

Click the link here to learn the strategy:

I want the Unfair Advantages!