Why It’s Important To Have Travel Credit Cards Traveling is an integral part of life for many Malaysians, offering a chance to explore new cultures, cuisines, and landscapes. After months of work, some of us surely need a lovely retreat to other countries or even during business travels. Credit cards are crucial during travel for […]

Traveling is an integral part of life for many Malaysians, offering a chance to explore new cultures, cuisines, and landscapes. After months of work, some of us surely need a lovely retreat to other countries or even during business travels.

Credit cards are crucial during travel for their convenience, security, and ability to provide emergency funds. Additionally, they offer rewards and perks, and their widespread acceptance ensures smooth transactions worldwide.

This guide delves into the top 5 travel credit cards for Malaysians, designed to enhance your travel experience while providing value and convenience.

The Alliance Bank Visa Infinite card is a top-tier choice for travelers seeking to accumulate rewards quickly. Offering up to 8X Timeless Bonus Points on selected spendings, cardholders can rapidly accrue points to redeem for flights, hotel stays, and more.

Imagine planning a trip to Europe. By booking your flights and hotels using the Alliance Bank Visa Infinite card, not only do you manage your expenses with the 0% Flexi Payment Plan, but you also earn significant points to redeem towards future travel, all while enjoying lounge access during layovers.

HSBC TravelOne stands out for its robust rewards program and lounge benefits, making it a solid choice for those who value points flexibility and comfort during travel.

Consider you’re eyeing an impromptu weekend getaway. Using the HSBC TravelOne card for booking, you instantly redeem points for a flight and hotel, significantly reducing your out-of-pocket expenses. Plus, the lounge access provides a peaceful start to your journey.

UOB PRVI Miles card is perfect for travelers who enjoy earning rewards and cashback on their spending, along with discounts on ride-sharing services.

When traveling to Singapore, using your UOB PRVI Miles card for dining and shopping can earn you significant rewards and cashback. Plus, the Grab discounts make exploring the city more affordable.

The Standard Chartered Journey card is designed for those who value unlimited lounge access and convenient airport transfers, offering a seamless travel experience.

For business travelers frequently flying out of KLIA, the unlimited lounge access and complimentary Grab transfers offer a hassle-free travel experience, from the moment you leave your home to boarding your flight.

CIMB Travel World card is the epitome of luxury travel, offering extensive lounge access and exclusive stays at Marriott Vacation Club properties.

Planning an annual family vacation becomes more rewarding with the CIMB Travel World card. The complimentary Marriott stays offer luxurious accommodation options, while the extensive lounge access ensures your travel comfort at various airports.

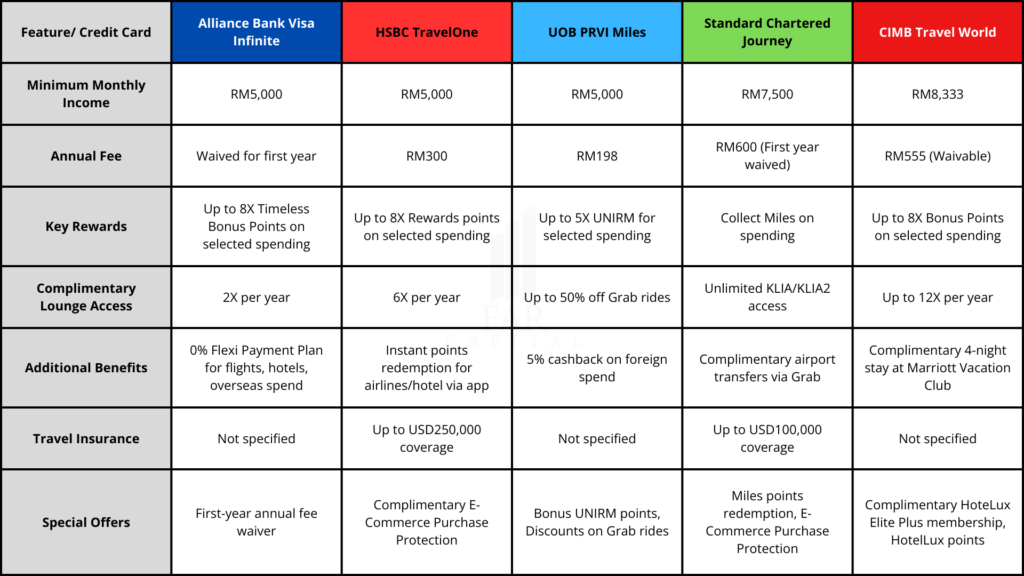

Still can’t decide which one is the best for you? Don’t worry, we got you covered. Here’s the TL;DR for you to compare more easily.

Choosing the right travel credit cards can significantly enhance your travel experience, offering benefits that range from bonus points and cashback to luxurious lounge access and complimentary stays.

Whether you’re a frequent business traveler or planning your next family vacation, there’s a card tailored to your travel needs and spending habits.

Consider your travel frequency, preferred benefits, and income to select the card that best suits your lifestyle, ensuring your travels are not just about the destinations but also the journey there.

Before we wrap this article up, we have something big to offer you guys who have read it until the end (we appreciate it, though). At this point, surely you already have a choice of which travel credit card you are into – but what if we tell you that you can travel without adding more commitments?

What if you can travel without applying for more credit cards – which might burden you at some point due to high-interest rates? Of course, as we showcased in the article – these cards are useful if you are a frequent flyer, but to travel without worrying about adding another bad debt doesn’t sound bad, too, right?

If you want to learn more about this strategy – which thousands of Malaysians have already implemented and are proven to be effective, we are going to share a portion of it for free. All you need to do is click THIS LINK and learn how you can travel without having to add more high-interest debts.

We have been awakening Malaysians to enhance their financial literacy and educate them about property investment for almost two decades now, and we’re not slowing down. We will not stop until most Malaysians can uplift our financial lives and live better.

(Bonus: If you feel indecisive, not sure whether you should get a travel credit card, and you feel like you need reassurance, you can always talk to our Success Managers any time. With their experience, you will understand your financial future pre and after-purchase. If you’re interested, reach out to them HERE.)

We hope this article has been insightful, and we’re excited to help you achieve your goals. Feel free to share this article with others who might benefit from it as well.