This is the ultimate guide for you, first home-buyers.

It’s common for property investor to make money for their first purchase.

But, why can’t you?

But work without a proper “Strategy” Is just sailing in the sea without destination

So, how do you know whether you are ready or if you have a strategy to buy your first property?

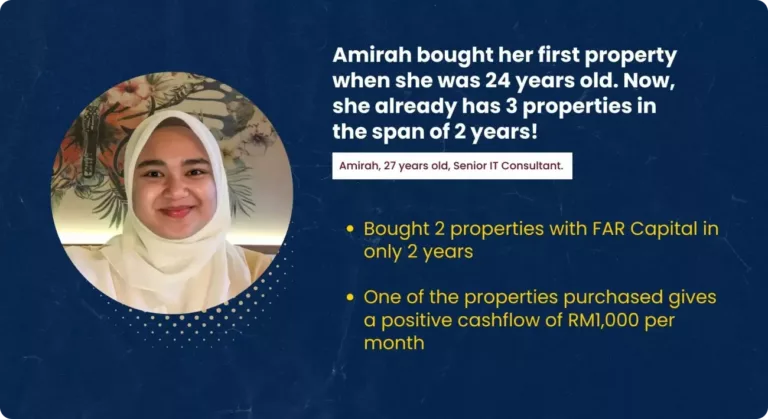

At FAR Capital, we advise our clients to start making money 'Right After' they buy their property.

We believe that everyone should become profitable Right After Purchase—not after 5 years, not even after 10 years.

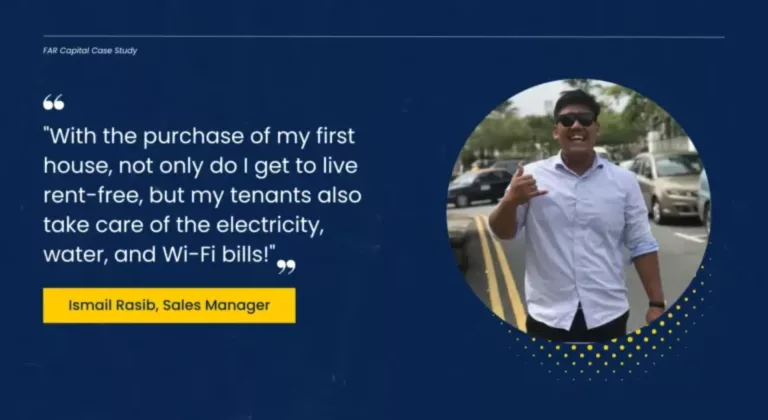

Ismail Rasib is Malaysian working in Singapore, purchased a 4-bedroom property through us and decided to rent out three of the rooms to the outsider.

Now, his home installment is covered by the monthly rental, and the best part is that he continues to generate a positive cash flow of approximately RM300 per month.

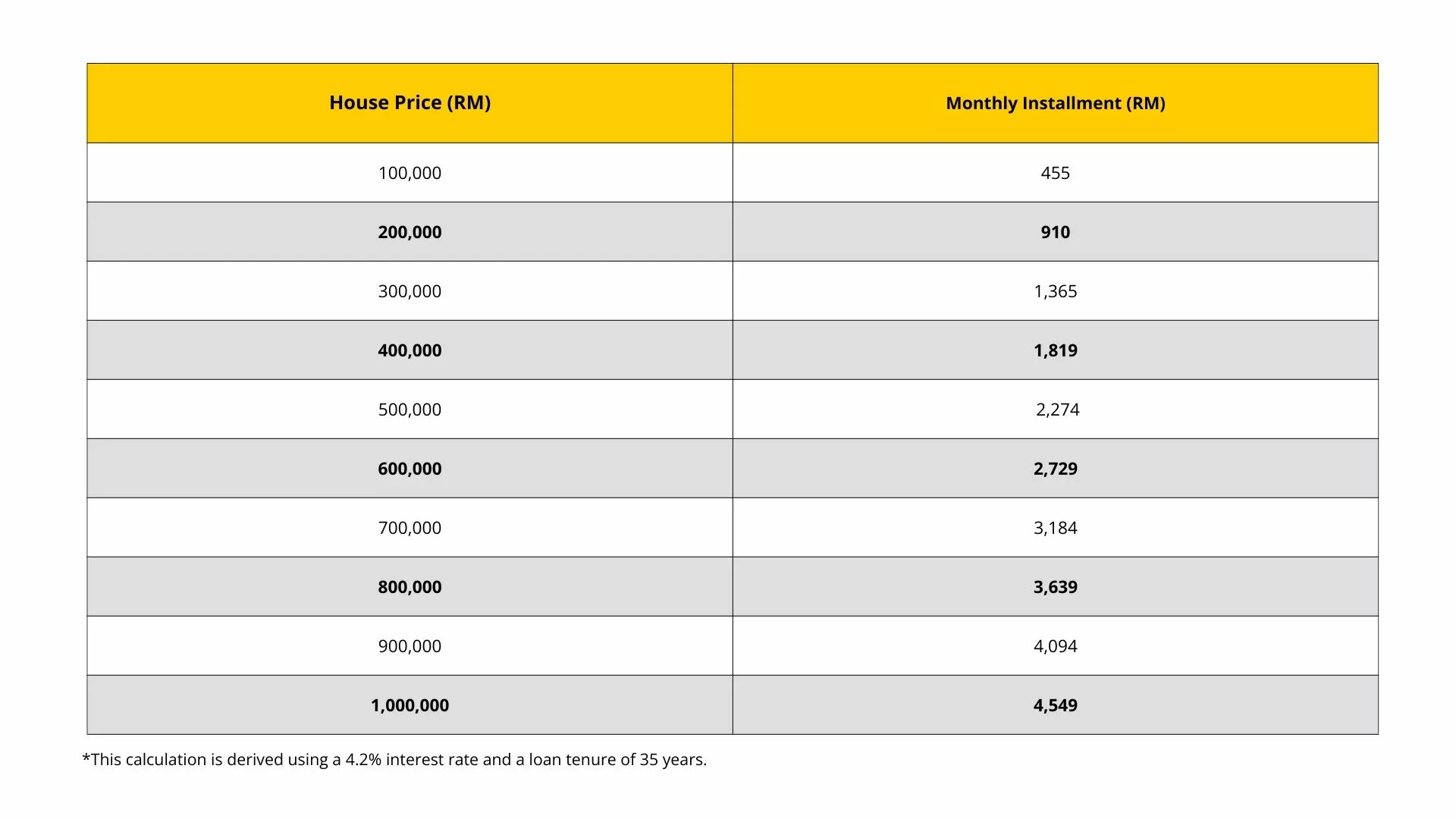

You need to have at least RM70,000 savings in order to buy one property from subsale or auction!

Nearby MRT and a mall

Completed property

Commission earner, foreign income, and business owner friendly

Starts from only RM480,000

RM300 positive cashflow at best case scenario with up to RM120K cashback

Up to RM70K cashback with RM500 positive cashflow at the best-case scenario

Positive cash flow in the range of RM300 - RM900 excludes principle for the worst and best case scenario

RM120,000 cheaper.

Lowest price below RM400,000 per unit

Most two-bedroom units in this area are selling at an average of RM750,000, so we are purchasing at nearly a 50% discount. This is even cheaper than an auction!

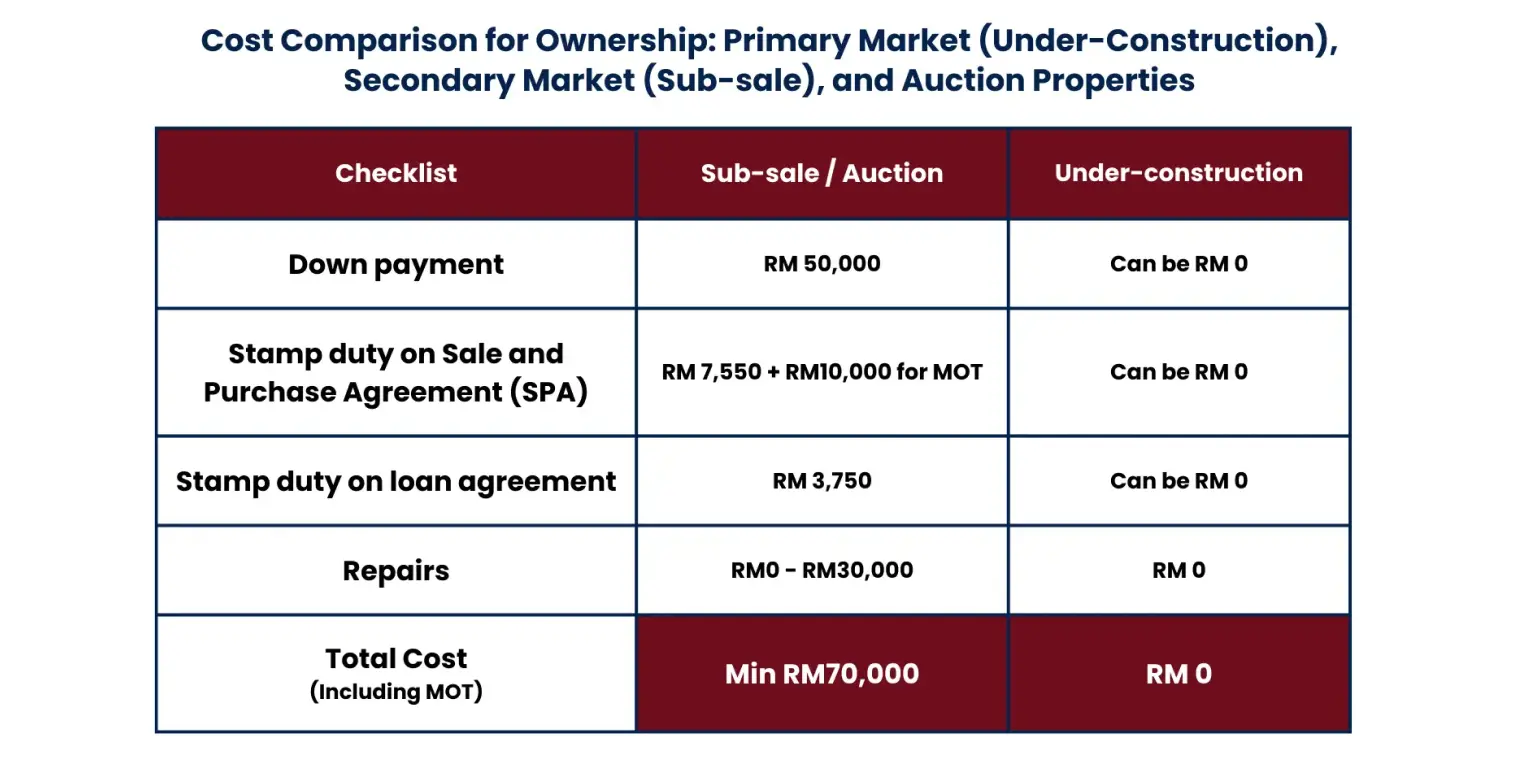

So, If you're considering buying a property, make sure that you have these advantages so you won't need to fork out your savings for the deposits.